Stakeholders of the Botswana Pensions Society (BPS), amongst them Trustees and Principal Officers of retirement funds, fund administrators, compliance officers, human resource practitioners, and other financial industry leaders converged in Maun, in large numbers, on the 25th and 26th of February to attend the historic two day, BPS 2019 Annual Conference. The theme for 2019 was “The importance of ethics and values in the formulation of strategies for sustainability in the financial services sector” which was fitting and appropriate, given that the 2018 conference was themed, “Pension Fund Governance in Africa: Challenges and Potential Solutions.” In his welcome remarks, BPS Chairman, Peter Hikhwa started by giving a brief review of the Society’s 2018 activities, which included an annual conference and two trustee seminars. Thereafter, he proceeded to welcome the Guest Speaker, Ms Leilani Sanders Hall, Co-Head of Ethics, Standards and Professional Conduct at the Chartered Financial Analyst (CFA) Institute and said, “We feel extremely honored to have the CFA Institute grace our event. Our theme resonates with their mission statement which reads, To lead the investment profession globally by promoting the highest standards of ethics, education, and professional excellence for the ultimate benefit of the society.”

Hikhwa went on to shed light on the conference theme, that is, ethics as a study of moral values and listing examples of ethical values such as justice, honesty, empathy, compassion, respect, responsibility, integrity, fairness and so on. He concluded by highlighting the need to develop ethical leaders who lead by example and said that, this was a pre-requisite to the smooth running of the industry. In ending his remarks, Hikhwa expressed gratitude to the following Sponsors,without which, the conference would not have been possible:

• Platinum Sponsor – Investec

• Gold Sponsor – Stanbic Bank

• Silver Sponsors – Bifm/Botswana Life, AON & RMB

• Bronze Sponsors – Alexander Forbes, African Alliance, STANLIB,

Liberty Life and Allan Gray

• Other Sponsors – Kgori Capital and RisCura

For his part, Former Commissioner General of Botswana Unified Revenue Service (BURS), Ken Morris stressed the need for BPS members to always

behave in a manner that is consistent with what is generally considered to be right or moral. In his view, ethical behavior should be seen as the foundation of professionalism in all disciplines. He said values on the other hand should be taken as the principles and ideals that provide the basics of making judgment of what is important. He advised that the quest for organizational changes or transformation must begin with a commitment of oneself and with each individual, be it a Trustee or Principal Officer, pursuing ethical behavior or moral excellence. Furthermore, he noted that as strategic leaders of organizations, it is also of great importance for them to ask themselves a question on how they can build an ethical climate which can guide them in their daily operations going forward. He said the five practical values of integrity, accountability, perseverance, diligence as well as discipline are the most important, adding that if followed, they can bring about success in the boards of Trustees and every other organization.

The conference Guest Speaker, Leilani Hall, started by stating the CFA Institute goal as an organization, which is, to lead the investment profession by promoting the highest standards of ethics, education and professional excellence for the ultimate benefit of society. In her presentation titled, “The power to make a difference”, she introduced the subject matter by explaining how she believed in “the power of one” and said, “Yes I firmly believe that one individual can make a difference in the world. It can be done with vision, commitment, persistence and discipline. We have seen it many times. But as much as I believe in the power of one, I know that real sustainable change and growth comes from the collective that shares that vision, commitment, persistence and discipline. The power of the collective cannot be stopped. The world can be altered, and the lives of billions of people can be impacted in positive

ways.”

Why most small business fail in the last year?

Hall then went on to outline the following four steps on which to focus, in order to support “Investment Management Growth” worldwide.

- a) Revising Our Business Models

Hall said, “It is important that we make a difference in local communities and capital markets, like you are doing here in Botswana. While we strongly believe in fair compensation, we believe that our profession needs to be led by professionals with a sense of purpose. Our business models must align with that sense of purpose even if it means a contraction in profits.”

- b) Take the Lead

Hall remarked, “We think our professional community can and must take the lead in earning back trust and advocating for candor and transparency. Leading with candor means being realistic and honest about our clients’ potential outcomes and prospects, even when it may hurt us financially to do so. It means taking strong stands against products and practices that put investors at a disadvantage and are not suited to their needs.”

- c) Hire the Right People

Hall observed that, “We need people who are not only smart, hard-working, dedicated but with a strong drive to do what is right. Maintaining and being committed to an individual or professional Code of Ethic is absolutely essential. This means doing the right thing even when no one is watching. Change must also happen with our demographics. We all know that diversification is a core investment principle, one that produces better outcomes. When we hire people of diverse backgrounds – including gender, ethnicity, culture, mindset, and work style – and ensure their inclusion in the discussions – we improve our chances to outperform.”

- d) Embrace Change, particularly new Technologies

“The ability to embrace change is especially important in this age of disruption….. Some professionals fear new technology and see it as a threat to their futures. But we are far better off viewing new technologies as opportunities to expand our market and reach new investors. We must utilize, complement, and harness the forces of financial technologies,” commented Hall. Further, Hall noted that the CFA Institute as a not for profit organization was there to meet the many challenges emanating from providing service to their clients. In this connection, she further explained, that an integral part of the CFA Institute mission was to develop and administer codes and standards that guide the investment industry. These codes and standards included, amongst others, Premier Global Investment Standard, A Global Code for Asset Managers, Pension Trustee Code of Conduct, Pension Trustee Resources, Endowments Code of Conduct, etc.

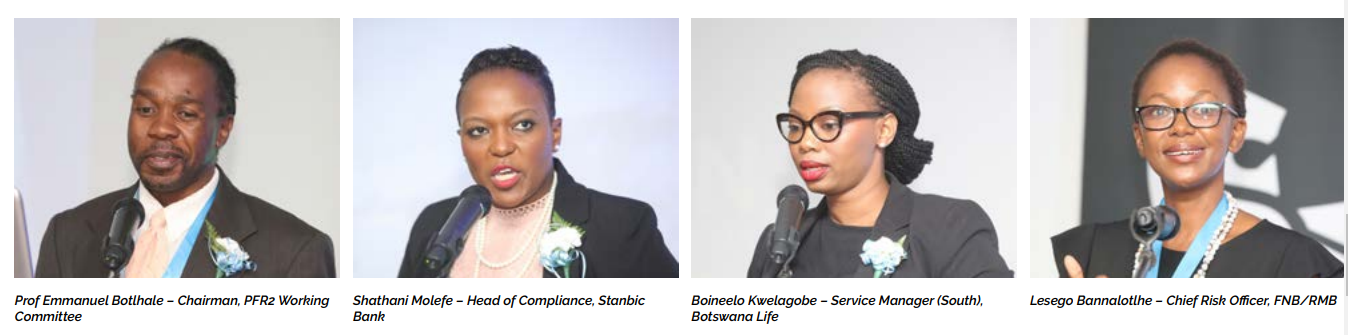

Various other speakers/presenters also made their contributions at the conference and these were: Phineas Sesinyi & Motsisi Mongati (NBFIRA), Antoinette Selemela Kula (FIA), Dr Pako Thupayagale (Investec), Prof. Emmanuel Botlhale (PFR2 Working Committee), Shathani Molefe (Stanbic Bank), Lesego Bannalotlhe & Dintle Samboma (FNBB & RMB), Boineelo Kwelagobe (Botswana Life) and Mothusi Lekaukau (AON).

The conference days were not left without exciting itineraries, as the delegates enjoyed highly interactive and extremely informative panel discussions facilitated by Kabo Motsumi (Liberty Life) and Dr Pako Thupayagale (Investec). The panel discussion topics were “Is there overregulation of nonbank financial institutions in Botswana? (BAOA, CA, BURS, FIA, NBFIRA, etc. their mandates and impact?)” and “The process of stock selection by asset managers and ethics”, respectively.

The conference ended with a very well attended gala dinner, where John Wellior (Hatab Member and Director, Maun Lodge) delivered a speech on “Tourism.”

Stay In Touch